20 Large Banks In Trouble

The latest report from Weiss Group ( see here) shows 20 of the largest banks in America could fail. The ratings for these banks appear very weak. One might ask, “What did the banks do with their bailout money?” Evidence reflects they may have used taxpayer bailout money to invest and profit take for their bank and/or possibly CEOs while raising credit card interest rates and stiffening loan qualifications for the taxpayers who bailed them out.

Don’t get me wrong. Is it a bad thing to require loan applicants prove they have the money, credit rating and income to pay for a mortgage on a property? I say no, it is not wrong. When customers with good credit scores, good payment history and solid performance have to pay the way for credit weasels through higher interest rates and

when banks profit through investing using taxpayer funds, ya gotta love the federal reserve system.

Clearly the international bankers profit taking is not and I repeat not because of the free market system, it is the federal reserve system. The Federal Reserve is not a government agency yet it does business with the federal government. Congress has the authority to coin money through the US Treasury so why have the Federal Reserve? Why have a bunch of international bankers fix our money issues causing inflation, deflation and recessions?

SunTrust Bank Blues

Detective Krum

SunTrust Bank – banking blues. As financial reports come through and TARP funds examined you can begin to understand the SunTrust Bank blues. SunTrust Bank appears to have over extended their reach in mortgage areas, particularly in the south. This over reach affects their borrowing power with other banks and lenders.

Let me ask you a question. If you had a bank and your bank lost a lot of money on foreclosures, how would you compensate your bottom line? What does SunTrust Bank do? It appears they raise their fees on their good customers. Someone needs to show them how to win friends and influence people. You would think SunTrust would lower their fees, offer perks, do anything for the public to get their business and get out of the mess they created for themselves. Here is a closer look (from a financial source) at SunTrust Bank’s problems:

“The downgrade was triggered by continued deterioration in SunTrust’s asset quality. Until fourth-quarter 2008, asset quality problems had been largely contained to home equity and Alt-A loans with high loan-to-value ratios, but are now beginning to spread to SunTrust’s large portfolio of first mortgage loans on residential properties,” said Standard & Poor’s credit analyst Charles D. Rauch. In addition, the portfolio of loans to regional home builders is weakening. SunTrust has been particularly vulnerable during this credit cycle because of its large real estate exposure in Florida, one of the most overbuilt markets in the country.

The deterioration in credit quality caused the bank to report a large pretax operating loss of $656.5 million in fourth-quarter 2008. The quarter was marked by another spike in loan-loss provisions, as well as higher credit costs (mortgage application fraud and insurance denial claims). Net charge-offs, delinquencies, and nonperforming assets continued to climb from already high levels. We expect loan-loss provisions and other credit costs to remain elevated, causing more pressure on profitability in 2009.

Current ratings on SunTrust reflect its well-established banking franchise and extensive deposit-gathering branch network across the Southeast U.S. SunTrust’s issuance of $4.85 billion of preferred stock under the U.S. Treasury’s Troubled Asset Relief Program bolstered capital levels, increasing the Tier 1 risk-adjusted capital ratio to approximately 10.8% at year-end 2008. We expect SunTrust, which reduced its quarterly common dividend to $0.10 per share, to continue to build capital ratios through the credit downturn. During the fourth quarter, SunTrust raised core deposits and issued FDIC-guaranteed debt to bolster its liquidity profile. As of year-end 2008, the bank was a net supplier of overnight funds, a position we deem prudent in this volatile banking market.

The negative outlook incorporates our baseline scenario that SunTrust’s financial performance will remain weak in 2009. We expect asset quality problems to worsen throughout the year. If credit losses rise materially above our expectations or if core profitability is not poised for a recovery next year, we could lower the ratings.

In addition, complaints have piled up against SunTrust. Allegations of holding deposits for days before crediting them to accounts, overdraft fees charged to accounts because deposits weren’t cleared, mailing bank cards to the wrong address and many others. These issues are not the way to get your bank in good graces with your customers. One must ask, does SunTrust Bank want customers or just their money?

SunTrust Bank Fraud Allegation

Detective Krum

There are many SunTrust Bank articles in this blog, just check the archives. SunTrust Bank has the highest fee schedule compared to similar institutions. The following complaint alleges SunTrust Bank fraud. Couple this complaint, if true, to the factual report showing SunTrust Bank partnering with Florida Trend Magazine to mislead the public regarding SunTrust Bank strength shows a pattern of what appears to be deceitful practices.

I have removed the name of the person filing this complaint. Here is a complete copy of the complaint:

Suntrust Bank fraud

I went online to find out if I had lost my mind… only to find out that there are millions of people just like me out there that have been defrauded by Suntrust Bank.

I have a small Internet business and use my bank card for all of my transactions. This way I always have a record of them. and un like a credit card I have no interest and can not spend beyond the cash on hand.

One night, about 11:00pm when checking my account I noticed that there was a $500.00 hundred dollar charge pending on the account. Mind you my balance at the time was $223.00. a couple of small “legitimate” charges for about $15.00 and 28.00 so this caused the account to be overdrawn. I quickly called the 800 number to find out what the charge was for. I was placed in an endless loop of about 35 minutes and then the call was dropped. I decided I would wait until morning since it was late.

When I contacted customer service the following morning I was told there was nothing I could do until the transaction posted to the account. However, I was given the name of the company that was making the charge. As i suspected the the charge was not from any of my vendors and was indeed fraudulent… Still they insisted there was nothing they could do until it posted to the account.. I checked my account daily to see if the transaction had posted (still not sure why we would wait for a fraudulent charge to post) each night I noticed that not only had the charge not posted but suntrust was now charging me nsf fees for the “unposted fraudulent charge” 32.00 first then 64.00 then 96.00 from the 17th to the 20th when it finally posted they had racked up over $200.00 in fees. Mind you my business is at a stand still because I can not purchase material or process orders.

When it finally posted I called customer service, who transferred me to the fraud department, who told me that I would have to sign and affidavit, have it signed and notarized, return it, and then wait 7-10 days for them to sort this out. I decided not to leave this to fax machines and customer service, I would go directly to the branch an speak with a manager. I did what they asked and was told the 7-10 days is perfectly acceptable for me to wait for this kind of thing to be cleared up . However, again my business is still on hold for another 7-10 days!

My question to any one is this….. why would they pay a “check card” transaction (not a credit card) that was more then the balance IF THE FUNDS ARE UNAVAILABLE RETURN THE CHECK OR DECLINE THE CHARG! The only logical reason is because they want to collect the fees so they allowed a fraudulent charge to be posted to my account even though there was only $200.00 in the account when the fraudulent 500.00 charge came through. Now my account is on hold because they decided to pay it against monies the were not available.

So now my company is on hold while they investigate a charge that they should never have paid in the fist place… and charging me overdraft fees for the privilege. my overdraft fees now have fees (extended overdraft fees)

I am finding an attorney and changing banks as soon as they finish their investigation!

SunTrust Bank has the highest fees and makes a great deal annually from fees as you will notice in their financial report. SunTrust Bank also participated in the bank bailout scheme and received TARP funds. Taxpayers paid to help bailout SunTrust Bank.

Weak Banks and Weak Bank Directory

Detective Krum

Many of our readers have sent me a message requesting we post a directory in a single blog post – I will accommodate in this post and I will put this post in our blog roll on the right. I will update this directory when possible but you’ll want to check newer posts to see if they are added to this directory.

Nationwide weak banks listed here.

Bank & Foreclosure News is posted here.

A close look at SunTrust Bank.

SunTrust Bank overview here. The v1-p.com link is not correct now.

SunTrust Banks Misleads Customers is posted here.

SunTrust Bank Failing? Is posted here.

Regulators looking at SunTrust Bank is posted here.

SunTrust Bank closes two offices is posted here.

SunTrust Bank fined again is posted here.

SunTrust Bank and Florida Trend Magazine collude? Is posted here.

SunTrust Bank’s rating falls is posted here.

SunTrust Bank sounds the alarm is posted here.

SunTrust Bank Considered Weak By Some is posted here.

SunTrust Bank having Accounting Issues is posted here.

SunTrust Bank Robbery is posted here.

SunTrust Charges Highest Bank Fees is posted here.

Arkansas Weak Banks is posted here.

Alabama Weak Banks is posted here.

Florida Bank Posts Include:

Weak Florida Banks listed here.

Florida’s Weakest Banks is posted here.

Weak Texas Banks listed here.

Weak Illinois Banks listed here.

Weak Arizona Banks listed here.

Answers for our readers is posted here.

Failed Banks List of 15 is posted here.

8 More Banks Fail is posted here.

Weak Banks as of 9/16/2009 is posted here.

Weak Banks as of 9/18/2009 is posted here.

Weak Banks as of 9/18/2009 Part 2 is posted here.

More Weak Banks posted here.

Is Your Bank Weak? Is posted here.

Failing Banks and Failing Insurance Companies is posted here.

Failing Credit Unions is posted here.

Failing Georgia Credit Unions is posted here.

Failing and Unclaimed Credit Union Deposits listed here. Post 2 is here. Post 3 is here. Post 4 is here. Post 5 is listed here.

FDIC – All banks with FDIC not covered anymore, see here.

SunTrust Bank Accounting Questions?

Detective Krum

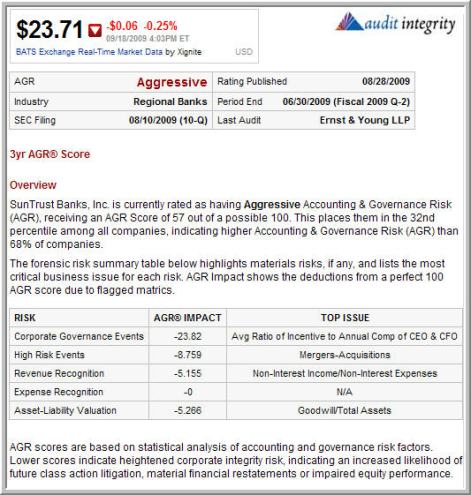

Statistical analysis of SunTrust Bank (STI) accounting practices may be reflecting a heightened corporate integrity risk. The chart below reflects an independent audit report regarding SunTrust Bank. The future of SunTrust is still up in the air with revived Citi merger reports and questions regarding SunTrust’s corporate integrity.

Low scores in corporate ratings reflect a strong potential for future litigation against SunTrust.

William R Reed Jr. works as CEO of National Commerce Financial and about 2003, NCF merges with SunTrust and Reed comes along with the deal. Reed’s compensation in 2008 totaled nearly $3.4 million and in 2009 Reed retires. SunTrust has Reed hold his tongue about SunTrust , agree not to compete, not to solicite employees and Reed has to agree to “waive any claims he may have against the company”. Yet, SunTrust wants to hire Reed as a consultant for $62,500. per quarter and pay him $100,000 on September 1, 2011.

Thomas E. Panther is SunTrust’s Chief Accounting Officer. Maybe time to check him out more and review his numbers. It appears on August 11, 2009 Mr. Panther received 3,600 shares of SunTrust Bank Common Stock plus Mr. Panther appears to have a little over $1 million in a 401k. Prior to the 3,600 new shares added to his portfolio, Mr. Panther owned 1,800 shares. Is nearly tripling Mr. Panther’s stock shares in SunTrust a reward for his accounting competencies?

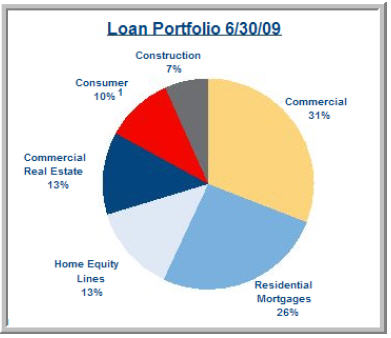

The chart below reflects what SunTrust’s loan portfolio reflects.

SunTrust Bank Sounds Alarm?

OK you need to stay with me on this one.

Colonial, a Montgomery, Alabama-based holding company, sought Chapter 11 protection, listing assets of $45 million and debts of $380 million. Its banking unit became the biggest bank to be seized by regulators since the collapse last year of Washington Mutual Inc.

The company provided funding for Taylor Bean & Whitaker Mortgage Corp., based in Ocala, Florida, the 12th-largest U.S. home lender, now suspended by federal agencies.

Yuji Saito, head of the foreign-exchange group in Tokyo said world economies are still doubtful. The yen strengthened after Atlanta- based SunTrust Banks Inc. said U.S. financial institutions may report more credit losses as commercial real estate falters.

Why is this an alarm, you ask? Disparities in banks’ loan values grew as the year progressed. When a loan’s market value falls, it might be that the lender would charge higher borrowing costs or, outsiders perceive a greater chance of default than management is assuming. Perhaps the underlying collateral has collapsed in value, even if the borrower hasn’t missed a payment. SunTrust Bank showed large divergence in their loan values. It showed a $13.6 billion gap as of June 30, which exceeded its $11.1 billion of Tier 1 common equity.

SunTrust is saying commercial real estate is next to fail. SunTrust had $15.9 billion in commercial real-estate loans as of June 30, or 13 percent of $122.8 billion in loans, according to a presentation to investors last week. The bank was not receiving interest on less than 1 percent of the commercial real-estate loans, SunTrust said.

Is it arbitrary accounting like Arthur Andersen provided? Fair-value estimates in the short-term can be a poor indicator of an asset’s eventual worth, especially when markets aren’t functioning smoothly and market prices are falling. The problem with relying on management’s intentions is that they may be even less reliable.